Private company data in the S&P product suite

Crunchbase

2024

Brief

Exploring possible ways Crunchbase insights and predictive data could live within the S&P Capital IQ product.

Project details

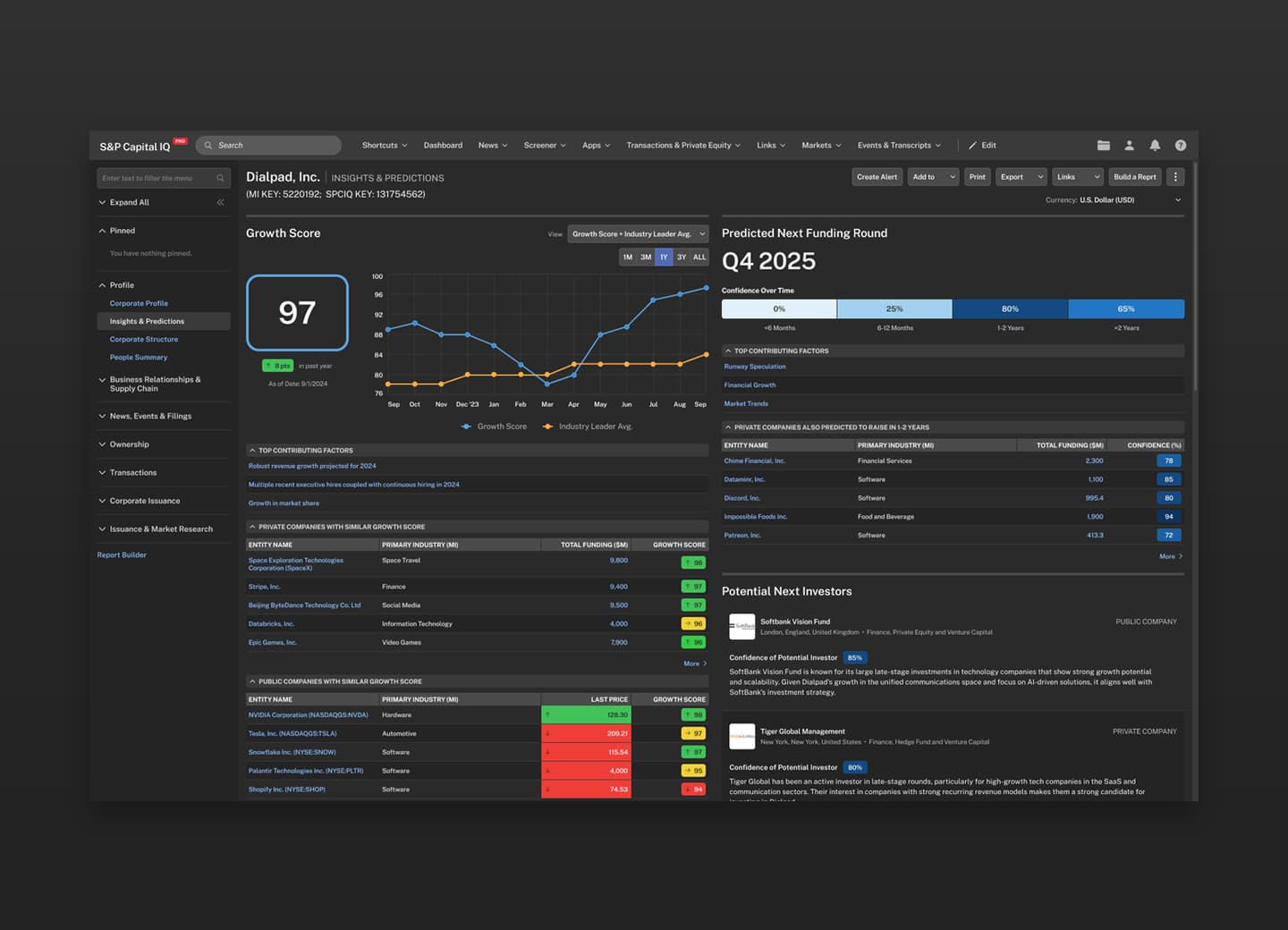

After completing forward-thinking projects for Crunchbase, I was invited to explore integrating its capabilities into the S&P product suite, specifically Capital IQ. I developed an interactive demo showcasing how Crunchbase data could enhance Capital IQ by introducing a private company dashboard offering predictive insights. Collaborating closely with the CEO, I adapted Crunchbase's strengths into a new context, envisioning a platform that could transform how Capital IQ users interact with data for smarter decision-making.

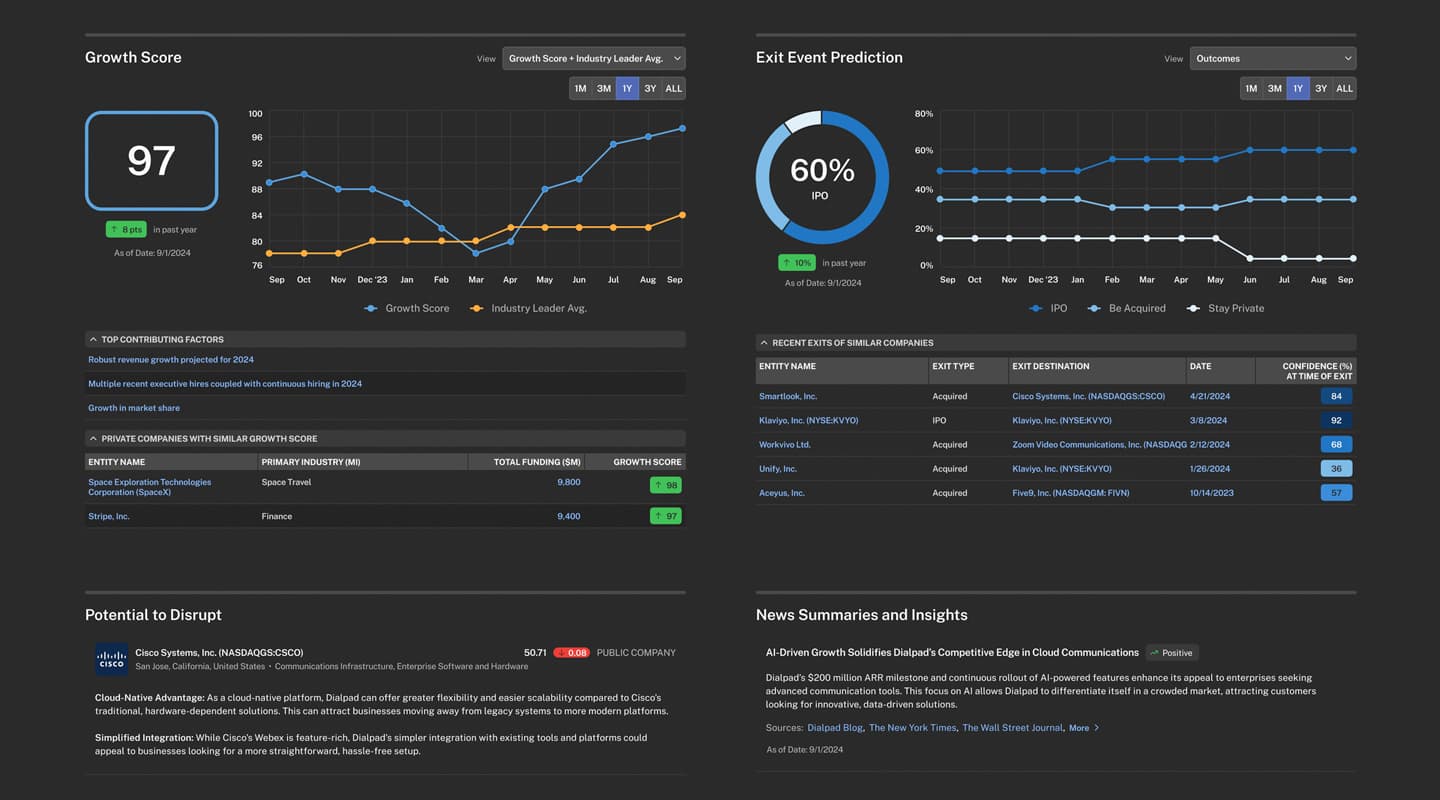

Translating insights

After dedicating substantial time to exploring the future of Crunchbase, a wealth of ideas emerged regarding the potential for insights and predictive analytics within the platform. Concepts such as a composite growth index, prediction horizons for events like future funding rounds or exits, news summaries with sentiment analysis, and assessments of a company’s potential to disrupt markets or competitors were among the many possibilities considered.

I began translating some of these ideas into the Capital IQ product, which introduced a significant challenge: I lacked direct access to the Capital IQ platform. To overcome this, I relied on images and videos from the web to guide the creation of styles and components in Figma, ultimately building an interactive prototype that emulated the Capital IQ product. I meticulously recreated visual elements, piecing together an experience that aimed to reflect the platform's functionality and aesthetics as accurately as possible. While there may be minor discrepancies, I believe this representation captures the essence of Capital IQ for those familiar with the product.

I began translating some of these ideas into the Capital IQ product, which introduced a significant challenge: I lacked direct access to the Capital IQ platform. To overcome this, I relied on images and videos from the web to guide the creation of styles and components in Figma, ultimately building an interactive prototype that emulated the Capital IQ product. I meticulously recreated visual elements, piecing together an experience that aimed to reflect the platform's functionality and aesthetics as accurately as possible. While there may be minor discrepancies, I believe this representation captures the essence of Capital IQ for those familiar with the product.

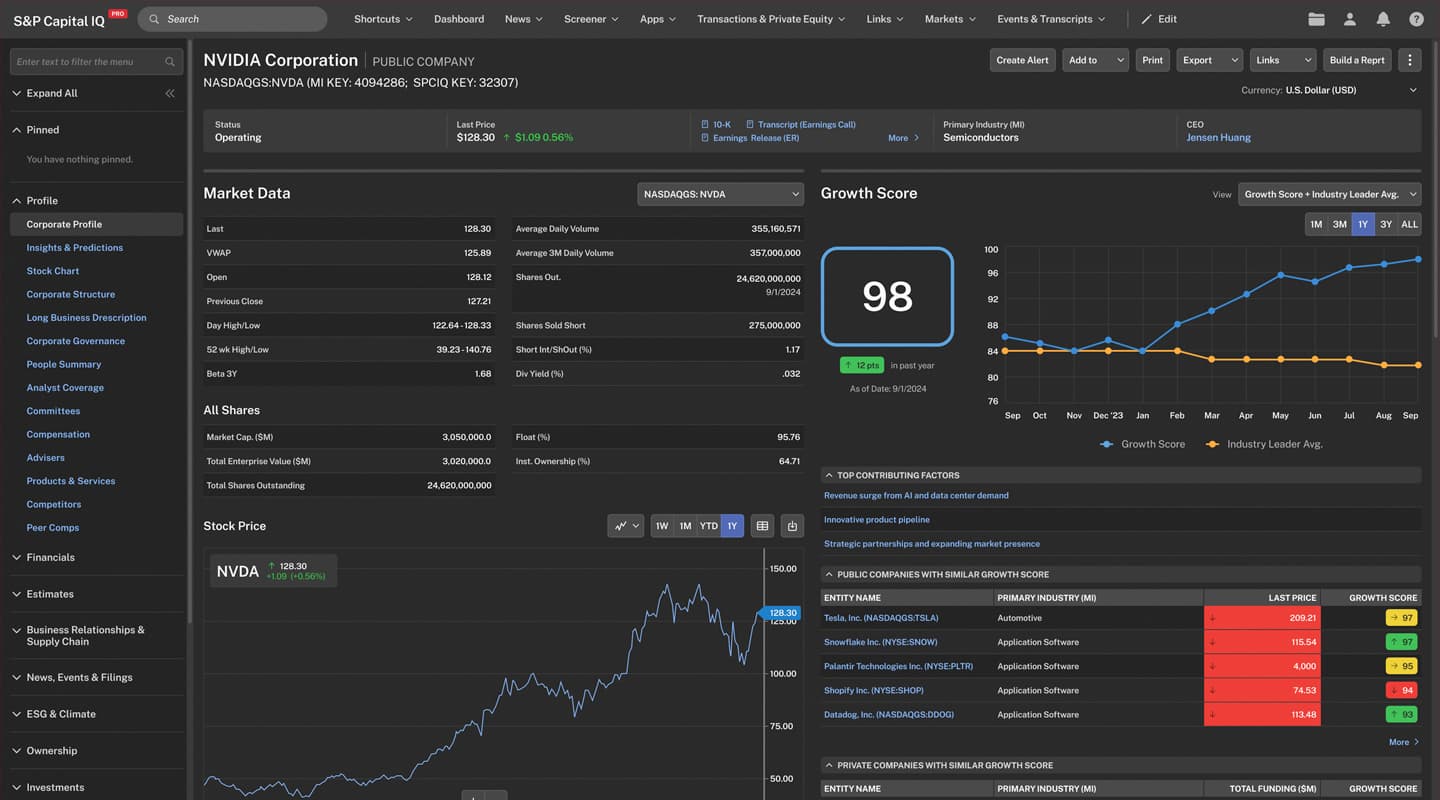

Not just for private companies

While addressing the need for insights and predictions on private companies was a key priority, it was equally important to explore how these analytics could be extended to public companies. Applying the same level of analysis to public entities, and allowing it to coexist alongside the vast trove of existing data, could offer a fresh perspective on evaluating public companies—especially in relation to their connections with both public and private counterparts. The ability to observe the dynamic interplay between public and private markets within a single company profile could revolutionize market analysis and has the potential to be a real game-changer.

Bringing it all together in a dashboard

Once I had mapped out the insights and predictions, combining Crunchbase’s vast data on private companies with the public data already available, the next step was to envision a comprehensive private markets dashboard. This concept aimed to bring together key metrics such as growth scores, industry-specific funding histories, predictions on funding rounds and acquisitions, and news insights—especially in relation to public companies and broader market trends. The resulting tool would provide a holistic representation of how these elements could interconnect, offering investors a rich understanding of both private and public markets. By uniting private market intelligence with public market data, the dashboard could serve as an indispensable resource, empowering investors to navigate the complexities of the market with a clearer perspective and make strategically smarter decisions.